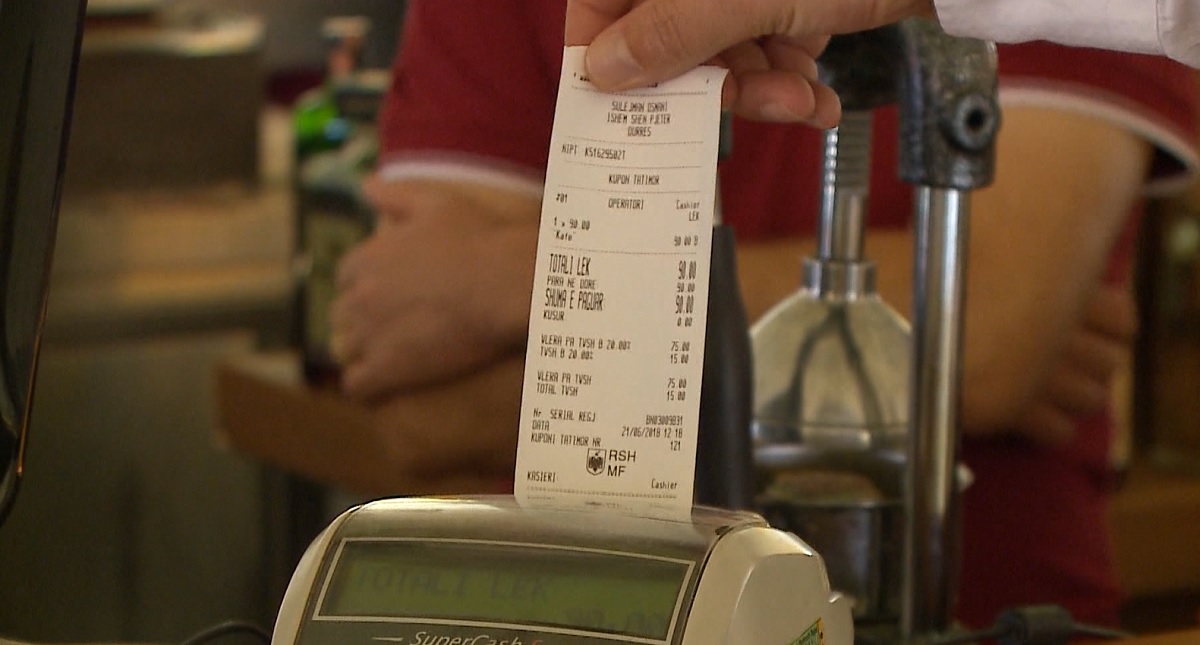

From January 1st, 2021, the Decision of the Council of Ministers no. 576 dated 22.7.2020 goes into effect, which changes the bracket of taxpayers, who have the obligation to declare and pay VAT.

Based on this Decision, all existing taxpayers, who for 2020 have realized a larger annual turnover or equal to 10 million ALL, have the obligation to declare and pay VAT, regardless of whether the taxpayer is registered for Profit Tax or Simplified Profit Tax.

The declaration and payment of VAT will be on a monthly basis and must be done within the 14th of the month following the reporting period.

The declaration of the books of Sale and Purchase will be on a monthly basis, with a deadline within the 10th of the following month.

For taxpayers, who have realized a turnover of less than ALL 10 million for the full calendar year 2020, the automatic deregistration of VAT tax liability will be performed, with a validity date of 31.12.2020.

Last from the rubric

-

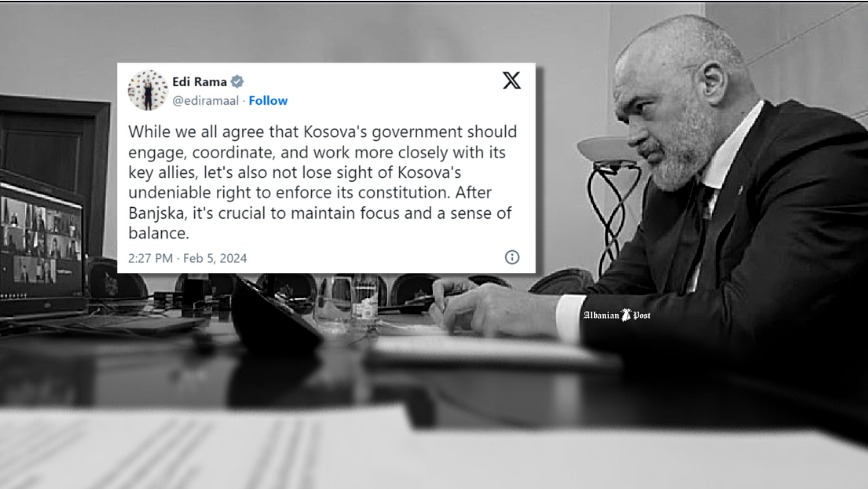

How should Edi Rama’s last tweet be read?

-

Rama confesses everything he knows about the Beleri case and shows the ‘fate’ he will have, in the exclusive for Kathimerini

-

ONE Albania welcomes the President of Hungary, on a courtesy visit to the company headquarters in Tirana

-

“History will record that the KLA and the United States were partners in preventing a genocide,” exclusive interview with James Rubin